When we talk about “8-15x EBITDA for DoubleU,” we are looking at a way to measure how well DoubleU is doing with its money. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It helps us see a company’s real profit without getting confused by other costs. The number “8-15x” shows how much people think DoubleU is worth based on its earnings.

If DoubleU has a higher EBITDA, it can be valued more. This means if DoubleU earns a lot of money, its value can increase. Knowing “8-15x EBITDA for DoubleU” can help you understand whether investing in the company is a good time. Let’s explore this idea more!

What is EBITDA and Why is It Important for DoubleU?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. This number shows how much money a company makes before taking out expenses. For DoubleU, understanding EBITDA is essential. It helps the company and investors see how well DoubleU is doing financially.

EBITDA clearly shows a company’s performance, including cash flow and profit. Investors use this number to make decisions, and they want to know if 8-15x ebitda for doubleu is a good place to spend money.

How to Calculate EBITDA for DoubleU

Calculating EBITDA for DoubleU is simple:

- It would help if you took the total revenue.

- You subtract the costs not included in EBITDA, like salaries and rent. This gives you the operating income.

- Add back the depreciation and amortization costs.

The formula looks like this:

EBITDA = Revenue – Expenses + Depreciation + Amortization.

With this formula, anyone can determine how well DoubleU is performing financially. It is a useful tool for better understanding the business.

Understanding the 8-15x Range: What Does It Mean?

The 8-15x ebitda for doubleu to how much investors are willing to pay for each dollar of EBITDA. If DoubleU has a strong EBITDA, people might pay 8 to 15 times that amount. This number shows how much confidence investors have in the company.

Investors use this range to evaluate DoubleU’s worth. A higher multiple means more trust in the company. It also shows that investors think DoubleU will grow in the future. Understanding this range helps everyone make more intelligent choices about investments.

Why Investors Care About 8-15x EBITDA for DoubleU

Investors pay attention to “8-15x ebitda for doubleu” because it helps them decide where to invest their money. A reasonable EBITDA means that DoubleU can earn more money, which is excellent for investors. The higher the EBITDA, the more valuable the company becomes.

Knowing this number helps investors plan for the future. If they see a solid EBITDA, they might buy shares. This can lead to more money for DoubleU to grow and succeed. Understanding this is key for anyone looking to invest.

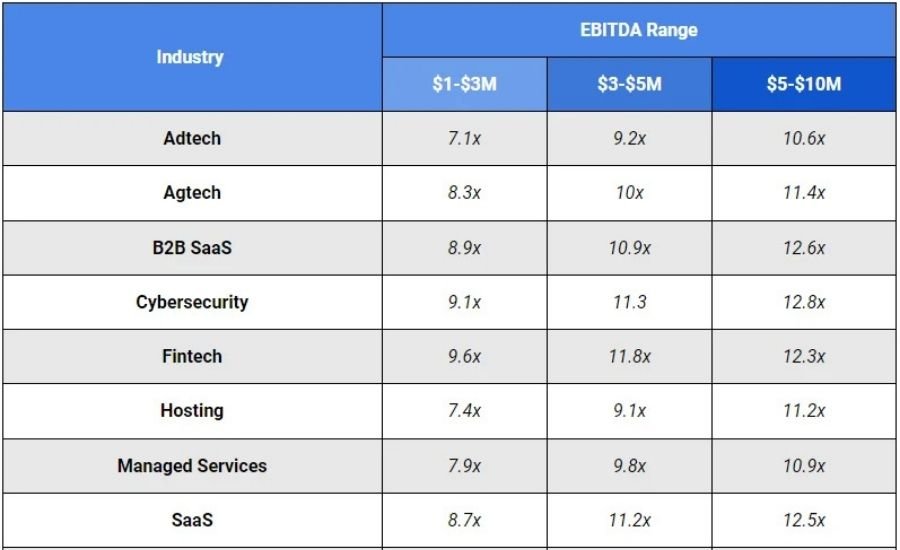

Comparing DoubleU’s EBITDA with Other Companies

When looking at “8-15x ebitda for doubleu,” comparing it with other companies is helpful. This shows how DoubleU stacks up in its industry. If DoubleU’s EBITDA is higher than that of its competitors, it may be in a good position.

Investors often look at the industry average. If DoubleU exceeds this average, it could attract more investors. Knowing how DoubleU performs compared to others helps everyone understand its market position.

How to Use EBITDA to Make Smart Investment Decisions

Investors can use EBITDA to make wise choices when investing in DoubleU. First, they should look at the trends in EBITDA over time. If it is growing, that is a good sign! This means the company is becoming more profitable.

Next, investors should compare DoubleU’s EBITDA with the industry average. If it is higher, that shows strength. These steps help investors feel confident in their decisions and may lead to successful investments.

The Benefits of a High EBITDA for DoubleU

A high EBITDA for DoubleU brings many advantages. First, it can lead to better investor confidence. Investors who see a strong EBITDA feel more secure in their investment choices. This can lead to increased investment in DoubleU.

Also, a high EBITDA allows DoubleU to take risks. It can invest in new projects or expand its business. This growth can lead to even more profits in the future, benefiting everyone involved.

Common Misconceptions About EBITDA and DoubleU

There are some common misconceptions about EBITDA and its relationship to DoubleU. One mistake people make is thinking EBITDA includes all expenses. In reality, it does not include interest, taxes, or depreciation, which gives a clearer picture of profit.

Another misunderstanding is that EBITDA alone tells the whole story. While it is important, investors should also look at other financial metrics. Using EBITDA alongside other information is essential to getting a complete view of DoubleU’s financial health.

You Must Read: R2-calculation-using-devsq-and-prediction

How Market Trends Affect 8-15x EBITDA for DoubleU

Market trends can greatly influence “8-15x ebitda for doubleu.” Investors might be willing to pay more if the market is strong and companies are performing well. This means the multiple could increase, leading to a higher valuation for DoubleU.

However, if the market is down, the multiple could decrease. This shows that investors are being cautious. Understanding these market trends is crucial for anyone interested in investing in DoubleU.

Future Predictions for DoubleU’s EBITDA

Many people wonder what the future holds for 8-15x ebitda for doubleu. If the company continues to innovate and grow, its EBITDA could rise. This growth could lead to more investors showing interest.

Experts often analyze the market and company performance to make predictions. If DoubleU keeps doing well, the EBITDA will likely improve, leading to a brighter future.

Real-Life Examples of EBITDA Impact on Companies

Many companies show how EBITDA impacts business decisions. For example, a successful company might have a high 8-15x ebitda for doubleu. This allows it to take on new projects or hire more workers. It’s a great way to grow and succeed.

DoubleU can also use its EBITDA in similar ways. A strong EBITDA can help it attract better partnerships and investments. Understanding this helps everyone see why EBITDA matters in real-life scenarios.

Tips for Investors: Understanding 8-15x EBITDA for DoubleU

Finally, here are some tips for investors interested in “8-15x ebitda for doubleu.” First, always do your homework. Look at the numbers and understand what they mean.

Second, DoubleU’s performance should be compared with that of other companies. This can provide valuable context. Lastly, monitor market trends. Staying informed helps investors make the best choices for their money.

Conclusion

In conclusion, understanding “8-15x EBITDA for DoubleU” is essential for anyone interested in the company. This number helps investors see how much money DoubleU is making and how valuable it is. A strong EBITDA can attract more investors, leading to growth and success for the company. It’s a vital part of making intelligent decisions about investing.

Calculating and using EBITDA can help you understand the financial world better. By comparing DoubleU to other companies, you can see where it stands in the market. Keeping an eye on these numbers helps everyone make informed choices about their money and future investments.

Read More: iibzx-manage-fee

FAQs

Q: What does EBITDA stand for?

A: EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

Q: Why is EBITDA important for DoubleU?

A: EBITDA shows how much money DoubleU makes before certain costs. It helps investors understand the company’s profit.

Q: How do you calculate EBITDA?

A: You calculate EBITDA by taking total revenue, subtracting expenses, and adding back depreciation and amortization costs.

Q: What does the 8-15x range mean?

A: The 8-15x range shows how much investors might pay for each dollar of EBITDA. A higher number means more confidence in the company.

Q: How can I use EBITDA to make investment decisions?

A: You can use EBITDA to see if a company is growing and if it’s an excellent place to invest your money.

Q: Can EBITDA tell the whole story about a company?

A: No, EBITDA is important, but it should be looked at alongside other financial numbers for a complete picture.

Q: How do market trends affect DoubleU’s EBITDA?

A: Market trends can influence how much investors are willing to pay for DoubleU’s EBITDA, affecting its value.